CEX Quiz Answers 1 December 2024

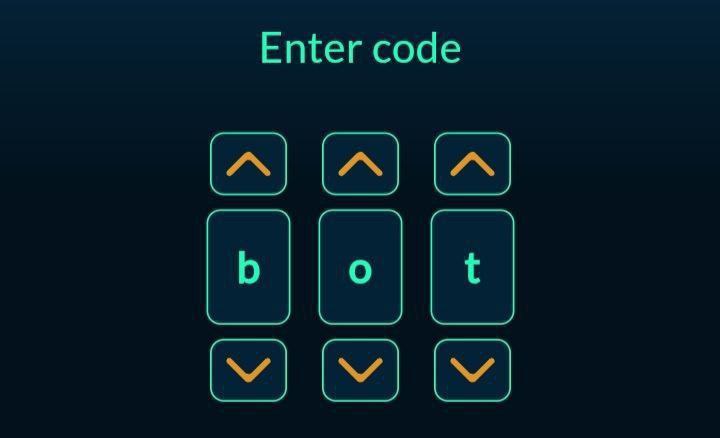

Open CEX IO Bot: https://t.me/cexio_tap_bot?start=1726737471260929

#CEXQuiz #CEXIOQuiz

Task: When and How to Use Short Positions in Trading

1. Why is technical analysis important for short orders?

– It helps identify trends and resistance levels.

2. What do you need to profit from a short order?

– A decrease in the asset’s price.

3. What’s a key risk management tool when shorting?

– Stop-loss.

4. Why should beginners start with smaller positions?

– To minimize risks and learn how shorting works.

5. What is a short order?

– Selling a borrowed asset expecting its price to drop.

6. Which of the following situations is a good time to consider shorting?

– When negative news affects market confidence.

7. What type of market trend is ideal for short orders?

– A downtrend.

8. Why is analysis important before opening a long order?

– It helps you make informed decisions about price trends.

9. What does leverage do in margin trading?

– Increases both potential profit and risk.

10. What’s the most important mindset when starting trading?

– Learn, analyze, and experiment.

11. What should traders monitor when holding a short order?

– Market trends and their stop-loss levels.

12. What does leverage do in margin trading?

– Amplifies both potential profits and risks

13. In trading, who handles the borrowing process for short orders?

– The trading platform.

14. What is one cost associated with shorting?

– Borrowing fees for holding the position.

15. What is the main goal of a short order?

– To sell high and buy back low

Open CEX IO Bot: https://t.me/cexio_tap_bot?start=1726737471260929

#CEXQuiz #CEXIOQuiz

Task: When and How to Use Short Positions in Trading

1. Why is technical analysis important for short orders?

– It helps identify trends and resistance levels.

2. What do you need to profit from a short order?

– A decrease in the asset’s price.

3. What’s a key risk management tool when shorting?

– Stop-loss.

4. Why should beginners start with smaller positions?

– To minimize risks and learn how shorting works.

5. What is a short order?

– Selling a borrowed asset expecting its price to drop.

6. Which of the following situations is a good time to consider shorting?

– When negative news affects market confidence.

7. What type of market trend is ideal for short orders?

– A downtrend.

8. Why is analysis important before opening a long order?

– It helps you make informed decisions about price trends.

9. What does leverage do in margin trading?

– Increases both potential profit and risk.

10. What’s the most important mindset when starting trading?

– Learn, analyze, and experiment.

11. What should traders monitor when holding a short order?

– Market trends and their stop-loss levels.

12. What does leverage do in margin trading?

– Amplifies both potential profits and risks

13. In trading, who handles the borrowing process for short orders?

– The trading platform.

14. What is one cost associated with shorting?

– Borrowing fees for holding the position.

15. What is the main goal of a short order?

– To sell high and buy back low

🤩 Farm CEXP tokens and earn rewards! CEX.IO App makes it simple and secure to buy, exchange, and store cryptocurrencies